New Zealand Banks Adopt SWIFTBIC Codes for Global Transfers

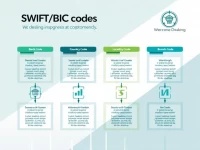

This article provides a detailed analysis of the SWIFT/BIC code of the Bank of New Zealand, explaining its structural composition and the importance of verifying the correct information. Additionally, it discusses the advantages of using Xe for international transfers, including better exchange rates, transparent fees, and fast processing times.